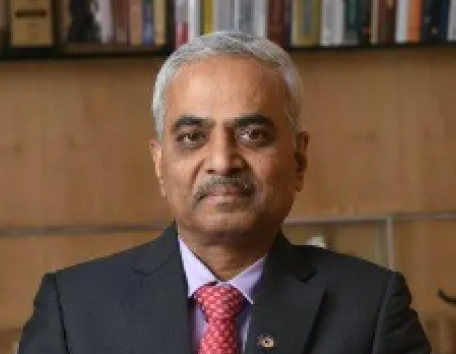

Satyananda Mishra

Non-Executive Chairman & Independent Director

Mr. Satyananda Mishra is the former Chief Information Commissioner of India (December 2010 to September 2013). He has a diverse and exemplary career of more than 40 years in the Indian Administrative Services (batch of 1973). He was the Chairman and Non-Executive Independent Director of the Multi Commodity Exchange of India Limited from November 2013 till November 2016. He served as the Director of the Small Industries Development Bank of India until 2018 and as a Development Commissioner for Small Scale Industries in the Government of India. Additionally, he has also held the position of Former Secretary for various government departments like the Department of Personnel & Training (DoPT), Public Works Department (PWD), and Department of Culture (MP Government).

Customer Login

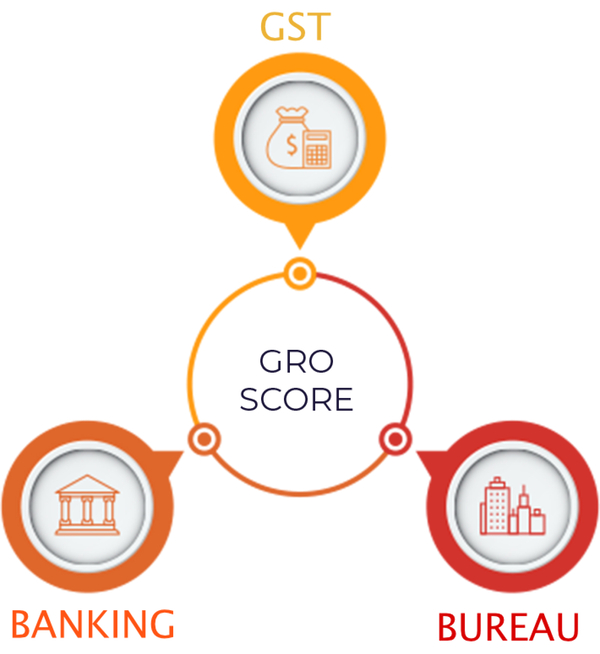

Customer Login GRO Score

GRO Score

Home

Home  About

About

Products

Products

Investors

Investors

Partners

Partners

In The Media

In The Media  Contact Us

Contact Us  Customer Login

Customer Login